In today's competitive market, flexible payment options are crucial for businesses to foster customer loyalty and retention. By offering a variety of payment methods like credit cards, digital wallets, bank transfers, and installment plans, companies cater to diverse consumer preferences, enhance convenience, and provide financial flexibility. This strategic move drives repeat purchases, positive word-of-mouth referrals, and ultimately boosts customer satisfaction and long-term business success.

Flexible payment options are transforming the way businesses interact with their customers, significantly impacting retention rates. In today’s competitive market, understanding customer preferences and tailoring experiences accordingly is crucial. This article delves into the power of flexible payment solutions, exploring how they enhance customer satisfaction and loyalty. We’ll discuss strategies to implement these options effectively, providing insights on optimizing payment flexibility to foster stronger customer relationships and boost retention.

- Understanding Customer Preferences and Their Impact on Retention

- The Role of Flexible Payment Options in Enhancing Customer Experience

- Strategies to Implement and Optimize Flexible Payment Solutions for Better Retention Rates

Understanding Customer Preferences and Their Impact on Retention

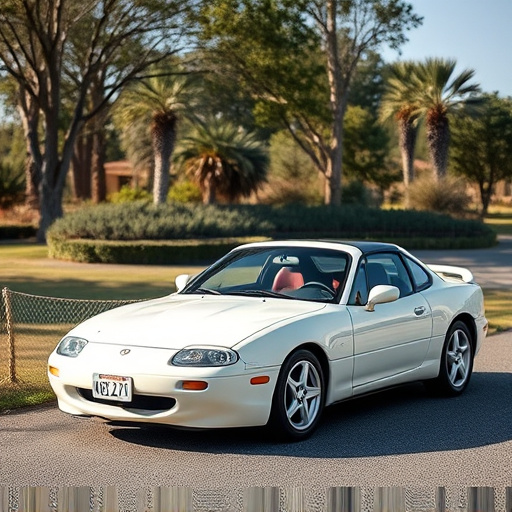

In today’s competitive market, understanding customer preferences is paramount for businesses aiming to foster loyalty and retention. Among various factors, flexible payment options play a pivotal role in shaping customer experiences and their subsequent decisions to return. The modern consumer values convenience and control, especially when it comes to making significant purchases. Offering flexible payment plans that cater to these desires can significantly enhance customer satisfaction and loyalty. This is particularly evident in industries such as automotive, where customers often seek vehicle enhancement or paint correction services but may be hesitant due to cost concerns.

Flexible payment options provide customers with the freedom to choose a repayment structure that aligns with their financial comfort zones. This could include installment plans, interest-free periods, or even partnerships with financing institutions for more extensive purchases. For instance, a car detailing business might offer a flexible payment scheme for comprehensive services like paint correction and UV protection, making these enhancements more accessible without burdening customers with large upfront costs. Such approaches not only increase the likelihood of repeat purchases but also foster a positive association with the brand, ultimately driving higher retention rates.

The Role of Flexible Payment Options in Enhancing Customer Experience

In today’s competitive market, providing flexible payment options is no longer a luxury but an essential strategy for businesses to enhance customer experience and foster loyalty. Customers appreciate the freedom to choose a payment method that aligns with their preferences, be it credit cards, digital wallets, or installment plans. This flexibility not only simplifies transactions but also builds trust and satisfaction. For instance, in industries like window tinting, where custom graphics and UV protection services are offered, flexible payment options can make these premium services more accessible to a broader customer base.

By implementing such options, businesses create a sense of inclusivity and convenience that encourages repeat purchases and positive word-of-mouth referrals. Moreover, it allows customers to manage their finances better without the stress of rigid billing cycles or high-pressure sales tactics. This tailored approach ensures that clients feel heard and valued, ultimately leading to higher customer retention rates and long-term business success.

Strategies to Implement and Optimize Flexible Payment Solutions for Better Retention Rates

Implementing flexible payment options is a powerful strategy to enhance customer retention and foster long-term relationships. One effective approach is to offer a range of payment methods, catering to various consumer preferences. This can include credit cards, digital wallets, bank transfers, and even installment plans. By providing multiple avenues, businesses ensure that customers have control over their financial decisions, making them more inclined to return.

Additionally, optimizing the process by integrating secure and user-friendly platforms is essential. Seamless transactions with robust scratch protection for sensitive data, such as credit card details, build trust. For businesses offering customizable products like vehicle wraps or custom graphics, flexible payment solutions can be tailored to match. This personalized experience not only increases customer satisfaction but also encourages repeat purchases and referrals.

Flexible payment options have emerged as a powerful tool to understand and cater to diverse customer preferences, ultimately driving retention rates. By offering tailored payment solutions, businesses can enhance customer satisfaction, build loyalty, and foster long-term relationships. Implementing these strategies not only improves the overall customer experience but also positions companies as forward-thinking, customer-centric organizations in today’s competitive market.