Flexible payment options, like installment plans and deferred payments, significantly influence buyer behavior by boosting confidence and affordability for large purchases, such as luxury vehicles with high-quality finishes. Businesses can enhance customer satisfaction by offering tailored financial solutions, integrating secure payment gateways, and implementing tiered plans with adaptable terms. This strategy fosters brand loyalty, encourages repeat business, and attracts new customers, ultimately driving growth in competitive markets.

Flexible payment options have become a game-changer in enhancing buyer confidence, especially in today’s digital era. This article explores the profound impact of these options on consumer psychology, offering insights into how they can significantly improve purchasing experiences. We provide a step-by-step guide to implementation and showcase real-world examples of businesses leveraging flexible payments to boost sales and foster customer satisfaction. Discover how these innovative strategies are revolutionizing the way shoppers interact with brands.

- The Impact of Flexible Payment Options on Buyer Psychology

- Implementing Flexible Payment Methods: A Step-by-Step Guide

- Real-World Examples: How Businesses are Leveraging Flexible Payments to Boost Sales and Customer Satisfaction

The Impact of Flexible Payment Options on Buyer Psychology

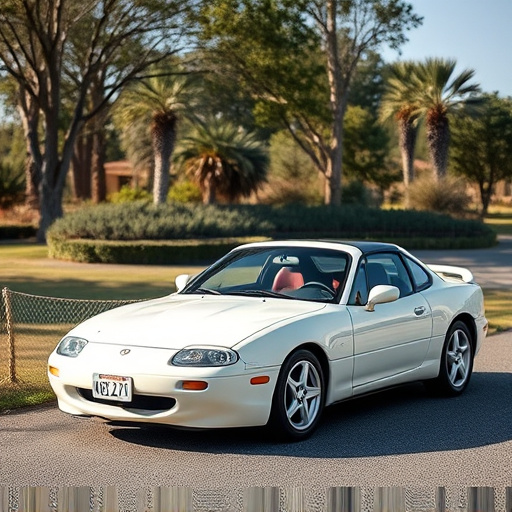

Flexible payment options have a profound impact on buyer psychology, fostering confidence and trust in their purchasing decisions. In today’s competitive market, consumers are often burdened with numerous financial commitments, making them cautious about substantial purchases. The introduction of flexible payment schemes allows buyers to distribute the cost over time, reducing the psychological pressure associated with a single, large expenditure. This approach encourages a sense of affordability and accessibility, especially for high-value items like vehicles or those featuring luxurious high-quality finishes.

By offering alternatives such as installment plans or deferred payments, buyers are empowered to make informed choices without compromising their financial stability. Furthermore, this flexibility is particularly appealing when considering additional vehicle protection measures, such as paint protection film, which can significantly enhance the overall value and longevity of a vehicle. Such options ensure that potential buyers feel more at ease, enabling them to focus on evaluating the product’s quality and features rather than being overwhelmed by payment concerns.

Implementing Flexible Payment Methods: A Step-by-Step Guide

Implementing Flexible Payment Methods: A Step-by-Step Guide

1. Assess Your Audience and Needs: Begin by understanding your target customers’ purchasing behaviors, financial constraints, and preferences for flexible payment options like monthly installments or interest-free periods. Tailoring these options to specific customer segments can significantly boost buyer confidence.

2. Choose the Right Payment Gateways: Integrate various secure payment gateways that support multiple payment methods, including credit cards, digital wallets, and bank transfers. Ensure these gateways offer robust security measures and efficient transaction processing for a seamless experience. This flexibility caters to different customer needs, enhancing their trust in your platform.

3. Implement Tiered Payment Plans: Offer flexible payment plans with varying terms, such as shorter, medium, or longer-term options. For instance, premium automotive services providers can propose a professional PPF (Paint Protection Film) installation plan where customers spread the cost over several months without interest. This not only increases accessibility but also demonstrates your willingness to accommodate diverse financial situations.

4. Simplify the Checkout Process: A user-friendly checkout process is vital for a positive customer experience. Ensure that incorporating flexible payment options does not complicate the purchase journey. Streamline forms, minimize clicks, and provide clear instructions throughout the process to build trust and encourage conversions.

Real-World Examples: How Businesses are Leveraging Flexible Payments to Boost Sales and Customer Satisfaction

In today’s competitive market, businesses are constantly seeking innovative strategies to boost sales and enhance customer satisfaction. One such powerful tool that has gained significant traction is offering flexible payment options. For instance, many automotive businesses are leveraging flexible payment plans for services like vinyl wraps and vehicle wraps, allowing customers to spread out the cost over time. This not only makes these premium services more accessible but also boosts buyer confidence, as it removes the financial burden of making a large, upfront payment.

As a result, satisfied customers are more likely to return for future services, such as paint correction, and recommend these businesses to others. This ripple effect contributes to increased sales and strengthens brand loyalty. Moreover, providing flexible payment options can help businesses attract a broader customer base, including those with limited budgets or cash flow constraints, ultimately driving growth and fostering long-term relationships with clients.

Flexible payment options have emerged as a powerful tool to boost buyer confidence and satisfaction. By offering diverse and convenient payment methods, businesses can significantly influence consumer psychology, making purchases more accessible and less stressful. This article has explored the step-by-step process of implementing these options and provided real-world examples demonstrating their positive impact on sales and customer retention. As the e-commerce landscape continues to evolve, embracing flexible payment solutions is a strategic move for any business aiming to thrive in today’s competitive market.