Selecting the optimal flexible payment platform is crucial for modern businesses, tailored to unique operational needs and diverse customer preferences. By evaluating security, integrations, and a variety of payment methods, companies can enhance customer satisfaction and retention in the digital landscape. Top platforms like PayPal, Stripe, and Square offer global reach, advanced customization, and cost-effective solutions, catering to e-commerce and niche sectors alike, with customizable pricing and features adapted to market trends and consumer expectations for flexible payment options.

In today’s dynamic market, offering flexible payment options is crucial for businesses aiming to cater to diverse customer preferences. This article guides you through the process of selecting the right platform to enhance your payment strategies. We’ll explore how understanding your business needs and customer demands is key to success. Subsequently, we’ll delve into essential features to look for and present a comprehensive comparison of top platforms renowned for their flexible payment options, empowering you to make an informed decision.

- Understanding Your Business Needs and Customer Preferences

- Key Features to Look for in a Flexible Payment Platform

- Top Platforms Offering Flexible Payment Options: A Comparison

Understanding Your Business Needs and Customer Preferences

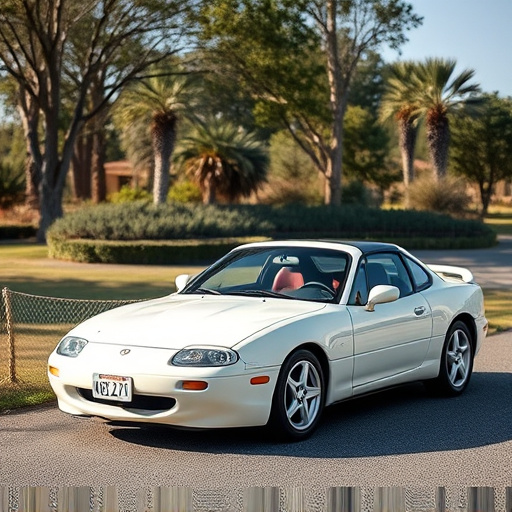

Understanding your business needs and customer preferences is a crucial step in choosing the right platform for flexible payment options. Every business is unique, with its own set of requirements and target audience. By thoroughly evaluating these factors, businesses can ensure they offer the most suitable flexible payment solutions. For instance, a company specializing in automotive services might consider platforms that facilitate transactions for protective coatings or vinyl wraps (vehicle wraps), catering to customers seeking convenient ways to pay for these specialized services.

Customer preferences play a significant role as well. Some clients may prefer the agility of split payments or interest-free installments, while others might be more comfortable with traditional payment methods. A comprehensive analysis of market trends and customer feedback will help businesses select a platform that aligns with both their operational needs and consumer expectations, ultimately enhancing customer satisfaction and retention.

Key Features to Look for in a Flexible Payment Platform

When evaluating flexible payment platforms, several key features stand out as essential for a seamless and successful implementation. Firstly, look for robust security measures to protect sensitive financial data, ensuring compliance with industry standards like PCI DSS. This is paramount in building customer trust. Secondly, consider integrations with popular e-commerce platforms and accounting software to streamline transactions and simplify record-keeping.

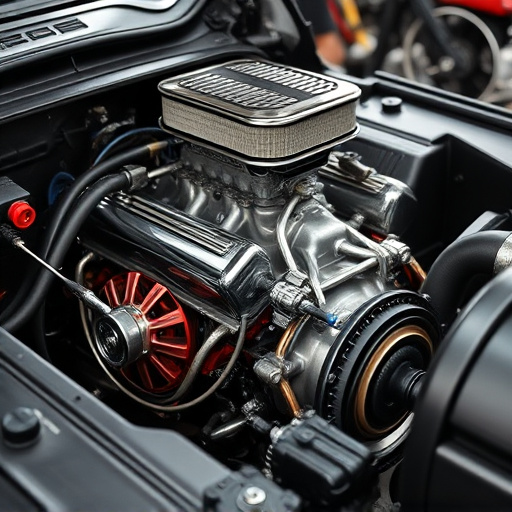

Additionally, the ability to offer various payment methods—including credit cards, digital wallets, bank transfers, and buy now, pay later options—is crucial for catering to diverse consumer preferences. Customization capabilities, such as the ability to create tailored payment plans or apply discounts, can enhance customer experience and boost sales, especially in sectors like car customization where high-quality finishes and custom graphics are sought after.

Top Platforms Offering Flexible Payment Options: A Comparison

When it comes to choosing a platform for flexible payment options, several stand out due to their comprehensive solutions and user-friendly interfaces. Among the top contenders are PayPal, Stripe, and Square. Each offers unique features catering to various business needs. For instance, PayPal is renowned for its global reach and secure transactions, making it ideal for international trade. Its easy integration with custom graphics and promotional campaigns makes it attractive for e-commerce businesses.

Stripe, on the other hand, excels in its advanced customization options, allowing businesses to tailor payment experiences to their brand identity. This platform supports various payment methods, including vinyl wraps for unique transaction scenarios. Square, known for its simplicity and affordability, is perfect for small businesses. It offers heat rejection features for efficient temperature management during peak usage times, ensuring a smooth checkout experience. These platforms’ flexibility in terms of pricing models and customization empowers businesses to adapt their payment systems according to market demands and customer preferences.

Selecting the optimal platform for flexible payment options is a strategic move that can significantly enhance customer satisfaction and business growth. By understanding your unique business needs, considering customer preferences, and evaluating key features, you can make an informed decision. This article has guided you through the process, highlighting top platforms, to ensure you offer a seamless and adaptable payment experience that keeps pace with modern consumer demands. Embrace the power of flexible payment options and watch your business thrive in today’s competitive market.