In a dynamic market where consumers juggle multiple financial commitments, e-commerce's rise drives demand for flexibility and convenience in purchasing. Businesses like vehicle wrap providers are responding by offering adaptable financing plans, allowing customers to enhance assets without upfront costs. Flexible payment solutions, including split payments, interest-free credit, and loyalty rewards, cater to diverse lifestyles and constraints. Integrating digital wallets and mobile payments is a strategic move to enhance client satisfaction, retention, and broaden the customer base, especially in light of recent global events.

In today’s dynamic market, understanding customer needs has become paramount. Among the most significant shifts is the demand for flexible payment options that cater to diverse financial scenarios. This article explores how businesses can adapt by implementing various flexible payment solutions, highlighting their numerous benefits. We’ll guide you through the process of adoption and optimization, ensuring your business stays competitive in an ever-evolving landscape.

- Understanding the Shift Towards Flexible Payment Options

- Types of Flexible Payment Solutions and Their Benefits

- Implementing and Optimizing Flexible Payment Systems for Businesses

Understanding the Shift Towards Flexible Payment Options

In today’s dynamic market, consumers are increasingly demanding flexibility and convenience when it comes to making purchases. This shift towards more flexible payment options is driven by several factors. Modern shoppers are often juggling multiple financial commitments, which means they appreciate the ability to spread out payments over time. Additionally, with the rise of e-commerce and online shopping, customers expect seamless and adaptable checkout processes that cater to their unique needs.

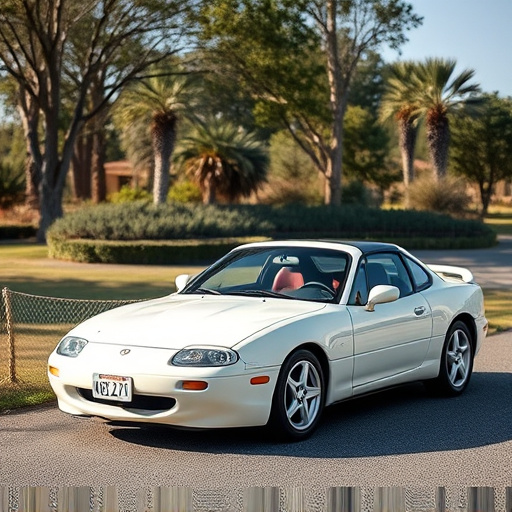

The concept of flexible payment options has gained significant traction, especially in sectors like vehicle enhancement. For instance, businesses offering vehicle wraps or vinyl wraps are now incorporating flexible financing plans to attract a broader customer base. This allows buyers to enhance their vehicles without the burden of a large upfront cost, making it an appealing option for those looking to add value to their assets while maintaining financial flexibility.

Types of Flexible Payment Solutions and Their Benefits

Flexible payment options have become a game-changer in the market, catering to diverse customer needs and preferences. These solutions offer more than just traditional cash or card transactions; they include various methods tailored to different lifestyles and financial situations. One such popular option is split payments, allowing customers to divide the cost over multiple installments, which is ideal for expensive purchases like vehicle vinyl wraps with custom graphics. This approach provides relief from immediate financial pressure, making high-value items more accessible.

Moreover, flexible payment solutions can include interest-free credit periods, loyalty rewards programs, and even payment plans tailored to specific products or services. For instance, a company offering vehicle protection packages might provide customers with the choice of paying for extended coverage in monthly installments. This not only makes essential services like vehicle protection more affordable but also fosters customer satisfaction by providing them with control over their expenses.

Implementing and Optimizing Flexible Payment Systems for Businesses

Implementing flexible payment options is a game-changer for businesses looking to cater to diverse customer needs. In today’s competitive market, offering multiple and adaptable payment methods can significantly enhance client satisfaction and retention. One way to optimize this strategy is by integrating digital wallets and mobile payments, ensuring convenience and security. For instance, businesses can partner with popular payment apps or adopt in-house solutions to accept contactless transactions, catering to customers’ preference for speed and safety, especially in light of recent global events.

Additionally, providing options tailored to specific customer segments can be a powerful strategy. This might include offering split payments for larger purchases, allowing clients to spread the cost over time. For businesses dealing with high-value items like custom car vinyl wraps or protective coatings that provide UV protection and scratch resistance, flexible payment plans can make their services more accessible. By implementing these options, businesses not only attract a broader customer base but also foster loyalty by demonstrating an understanding of individual financial circumstances.

Flexible payment options are transforming the way businesses cater to their customers’ needs, offering greater convenience and accessibility. By adopting various solutions like installment plans, split payments, and dynamic pricing, companies can enhance customer satisfaction and loyalty. Implementing these systems requires careful planning and optimization, but the benefits—from improved cash flow to enhanced data insights—make it a strategic move in today’s competitive market. Embracing flexible payment options is not just a trend; it’s a necessity for businesses aiming to thrive in an ever-evolving retail landscape.